An Unbiased View of Paul B Insurance

Wiki Article

Our Paul B Insurance Diaries

Table of ContentsFascination About Paul B InsurancePaul B Insurance - TruthsThe Single Strategy To Use For Paul B InsuranceThe Of Paul B InsuranceSome Known Facts About Paul B Insurance.The Ultimate Guide To Paul B Insurance

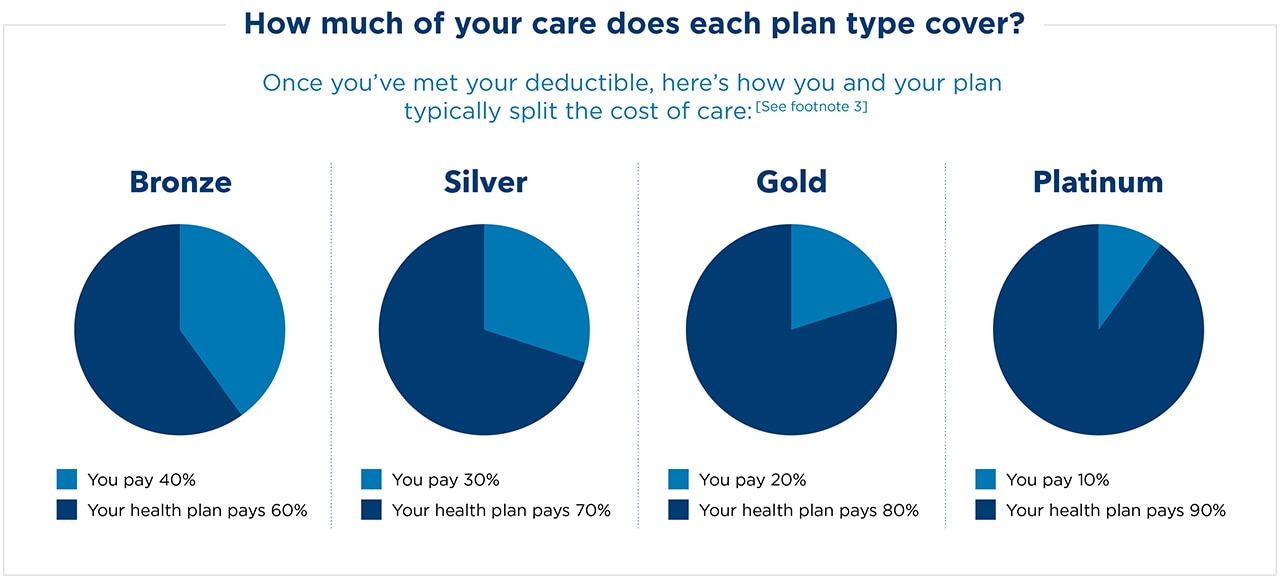

Coinsurance: This is the percent (such as 20%) of a medical charge that you pay; the remainder is covered by your medical insurance plan. Insurance deductible: This is the amount you pay for protected healthcare before your insurance coverage begins paying. Out-of-pocket maximum: This is one of the most you'll pay in one year, out of your very own pocket, for protected health and wellness care.

Out-of-pocket costs: These are all prices above a plan's costs that you need to pay, including copays, coinsurance and deductibles. Premium: This is the regular monthly quantity you pay for your health and wellness insurance coverage strategy. As a whole, the higher your costs, the lower your out-of-pocket costs such as copays as well as coinsurance (as well as the other way around).

By this action, you'll likely have your alternatives tightened down to simply a couple of plans. Right here are some things to think about following: Check the extent of solutions, Return to that recap of benefits to see if any of the plans cover a larger range of solutions. Some might have much better protection for things like physical therapy, fertility treatments or mental healthcare, while others may have far better emergency coverage.

Paul B Insurance Fundamentals Explained

In many cases, calling the plans' customer support line might be the very best way to obtain your questions answered. Create your questions down in advance of time, and also have a pen or digital device convenient to record the responses. Below are some examples of what you might ask: I take a certain drug.Make certain any strategy you select will spend for your routine and also needed care, like prescriptions and professionals.

As you're seeking the right wellness insurance coverage, an excellent step is to figure out which intend kind you require. Each plan kind equilibriums your expenses and also risks in a different way. Consider your healthcare use as well as budget to discover the one that fits.

Medical insurance (likewise called health protection or a health strategy) helps you spend for medical treatment. All medical insurance plans are various. Each strategy sets you back a different quantity of money and also covers various solutions for you and also participants of your household. When picking your insurance strategy, take some time to think of your family members's medical requirements for the following year.

Excitement About Paul B Insurance

You can locate strategy recaps and also obtain details regarding health insurance for you as well as your children in your state's Health and wellness Insurance coverage Market. This is an on the internet resource established up by the Affordable Treatment Act that helps you locate and contrast health insurance in your state. Each plan in the Market has a summary that includes what's covered for you and also your household.When comparing health and wellness insurance coverage plans, consider these expenses to help you make a decision if the strategy is ideal for you: This is the amount of money you pay each month for insurance coverage. This is the amount of money you need to invest prior to the plan begins paying for your healthcare.

This is the amount of cash you pay for each health and wellness care solution, like a browse through to a health and wellness treatment supplier. This is the greatest amount of cash you would have to pay each year for health treatment services.

Below's what to look for in a health insurance plan when you're assuming concerning companies: These suppliers have an agreement (contract) with a health insurance plan to give medical services to you at a discount. In a lot of cases, mosting likely to a preferred company is the least costly method to get health care.

The smart Trick of Paul B Insurance That Nobody is Discussing

This means a health and wellness plan has various expenses for different carriers. You may need to pay even more to see some service providers than others. If you or a family members member already has a wellness treatment supplier as well as you wish to keep seeing them, you can learn which prepares consist of that company.

When contrasting medical insurance plans, comprehending the differences in between health and wellness insurance coverage kinds can assist you select a plan that's best for you. Medical insurance is not one-size-fits-all, and also the variety of options mirrors that. There are numerous kinds of medical insurance plans to choose from, and also each has linked expenses and constraints on suppliers and also check outs.

To get ahead of the video game, examine your existing healthcare plan to assess your insurance coverage and comprehend your plan. And, examine out for more specific healthcare plan info.

Paul B Insurance for Beginners

If it's an indemnity plan, what kind? Is that HMO standard, or over at this website open-access? With lots of strategy names so unclear, just how can we figure out their kind? Considering that the Bureau of Labor Data (BLS) began reporting on clinical strategies over thirty years ago, it has actually recognized them by type. Obviously, strategies have transformed fairly a bit in thirty years.

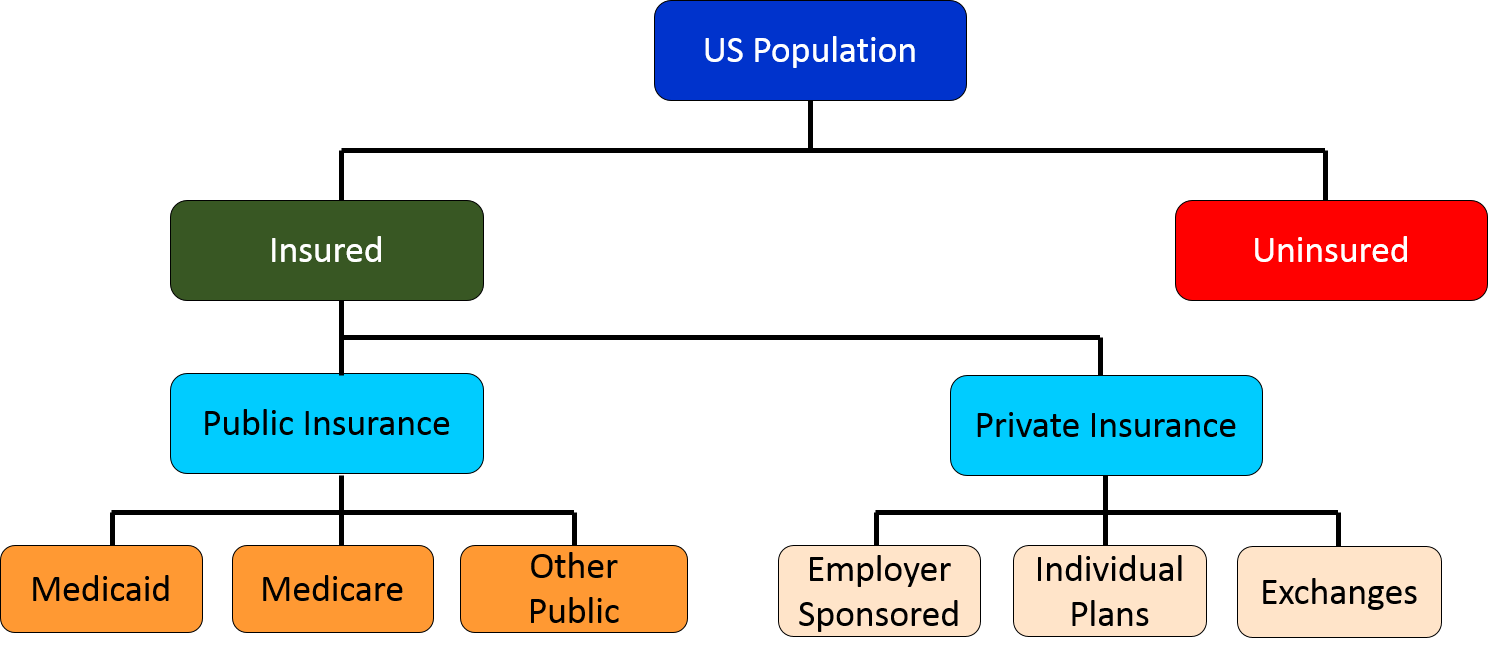

A strategy that acquires with medical carriers, such as medical facilities and medical professionals, to create a network. Clients pay less if they make use of providers that belong to the network, or they can make use of suppliers outside the network for a higher expense. A strategy comprising teams of medical facilities and also doctors that contract to offer thorough clinical services.

Such strategies typically have differing insurance coverage levels, based upon where service takes place. As an example, the plan pays much more for solution performed by a minimal collection of service providers, much less for services in a wide network of providers, as well as also much less for solutions outside the network. A plan that gives pre-paid detailed healthcare.

The Single Strategy To Use For Paul B Insurance

In Exhibition 2, side-by-side comparisons of the six sorts of medical care strategies show the differences identified by solution to the four websites questions regarding the plans' attributes. Point-of-service is the only plan kind that has even more than two levels of benefits, as well as fee-for-service is the only type that does not make use of a network.The NCS has actually not added plan types to Full Article account for these yet has actually identified them into existing plan types. As in the past, the plan name alone might not determine an one-of-a-kind as well as constant collection of functions. NCS does arrange details on some of these unique strategy characteristics, nonetheless. For instance, in 2013, 30 percent of clinical strategy individuals secretive sector were in strategies with high deductibles, and also of those employees, 42 percent had accessibility to a wellness interest-bearing account.

Report this wiki page